At Jelou, we closed 2025 with a fact that still sounds futuristic to many: our artificial intelligence agents processed more than 100 million dollars in credits, accounts, and payments (executed within a single system), without ever pulling users out of the chat where they already interact every day.

That’s why, when Andreessen Horowitz (a16z, one of the world’s most influential tech investment firms, known for anticipating major software cycles) stated that in 2026 the biggest risk for companies won’t be changing their systems, but continuing to operate on top of them, the statement didn’t feel exaggerated to us at all.

In recent weeks, other companies have begun to showcase progress pointing in the same direction, confirming that this shift is already taking shape in the market.

AI infrastructure-focused companies like ElevenLabs have introduced real-time voice agents operating directly inside messaging channels.

In parallel, mass-consumer platforms such as Rappi have announced new experiences that allow users to place orders by voice directly through WhatsApp.

These are interesting (and necessary) moves. Each, from its own angle, contributes to a broader transformation: conversation is no longer just a customer support channel. It is becoming the space where operations and transactions happen, where commerce and money actually move.

For Jelou, these announcements are a positive signal. They confirm a change we’ve been closely observing—and operating in production—for years. When interaction moves to conversation, the infrastructure that supports the business has to move there as well.

When Risk Is No Longer in Change

For years, changing a system was synonymous with danger. Migrating a core, replacing a critical platform, or touching operational processes was seen as a direct threat to business stability.

But in reality, legacy systems rarely fail all at once. They fail quietly—when they don’t scale, when they don’t integrate well, and when they generate constant operational friction.

In practice, this shows up as processes that should take minutes stretching into days; customers having to repeat their information; validations stuck “in progress” with no explanation; or teams stepping in manually to unblock what the system couldn’t complete on its own.

The system isn’t broken.

It’s just operating like an overworked engine: still running, but every operation requires more time, more people, and more effort than necessary.

A Long-Term Relationship with Messaging

For Jelou, this perspective on change doesn’t come from a recent prediction or a passing trend. It comes from a long-standing relationship with messaging as infrastructure.

In 2010, when digital communication was still fragmented across BlackBerry, Android, and iOS, we worked to connect all users into a single channel.

In 2012, we built an encrypted messaging application to enable secure transactions at a time when digital trust was still fragile.

In 2017, we enabled hundreds of thousands of people to check balances and pay for banking services directly through Facebook Messenger.

And three years ago, we crossed a threshold that once seemed unlikely: opening bank accounts 100% inside WhatsApp.

In hindsight, these technological milestones were signals that conversation was becoming the channel where decisions are made.

The Core Mistake: Adding AI Without Adapting the Foundation

Today, many companies feel an urgent need to implement artificial intelligence into their operations. In practice, the real challenge isn’t AI itself—it’s how to make it coexist with the systems that already sustain the business.

Those foundations remain valuable and necessary. The problem arises when they’re forced to operate at a speed, complexity, and level of interaction they were never designed for.

Without infrastructure that can adapt and orchestrate existing systems—rather than simply replacing them—the promise of efficiency breaks down. Processes appear automated, but fragment. Integrations rely on exceptions. Costs grow, without a meaningful improvement in the user experience.

Latin America as an Early Signal

In Latin America, this tension surfaces earlier because the way people interact has changed faster than the systems trying to support it.

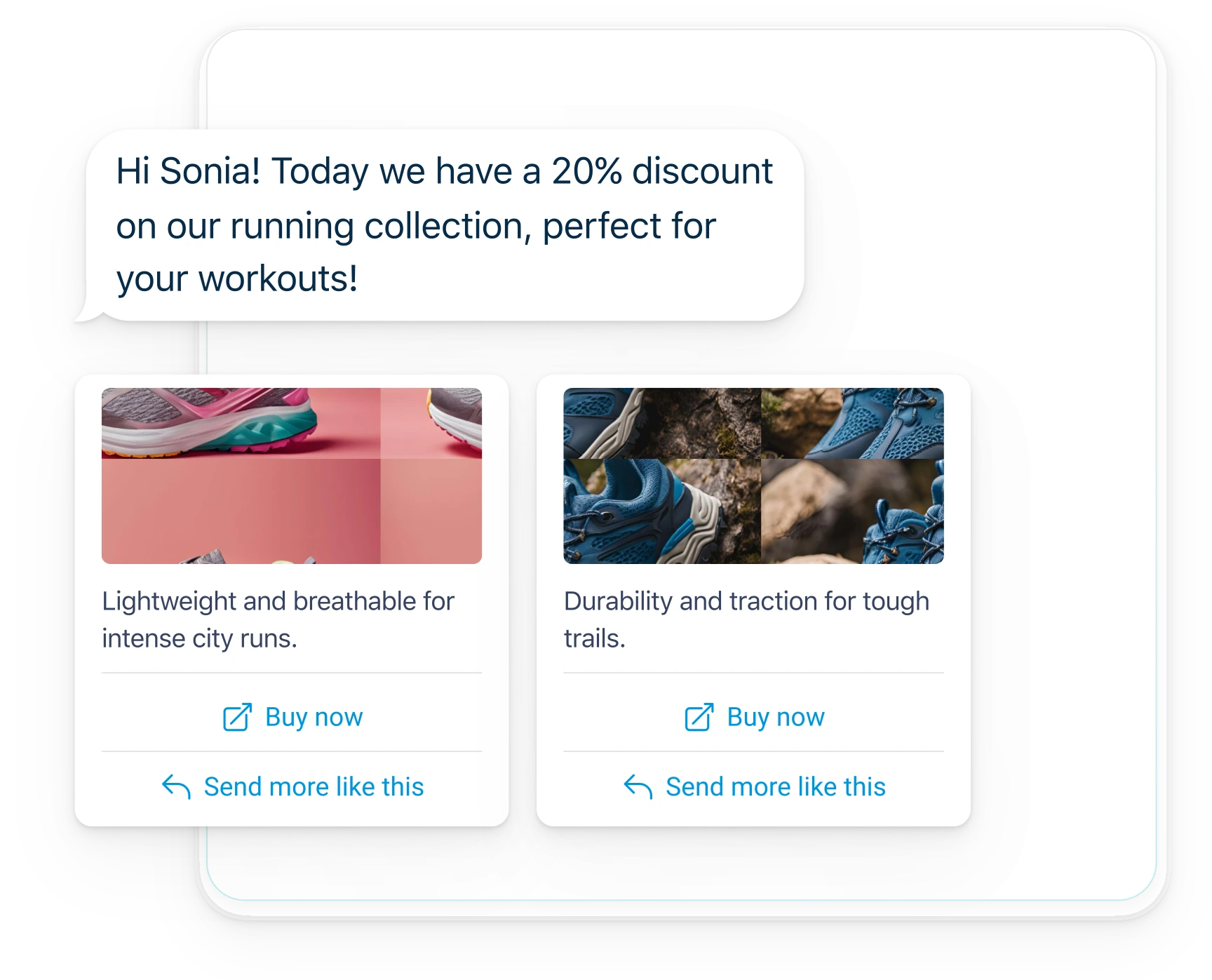

For millions of users, WhatsApp isn’t just a service channel—it’s where payments are made, contracts are signed, services are managed, and decisions are taken. Banks, retailers, entrepreneurs, and governments use it as a primary interface, not a secondary one.

When interaction moves and infrastructure doesn’t, the gap becomes obvious. This stops being a theoretical discussion when you look at real operations:

MiBanco (Peru) already executes complete financial services (credit applications, transaction inquiries, and more) entirely inside WhatsApp.

Banisi became the first bank in Panama to open thousands of accounts 100% through WhatsApp.

They didn’t get there by “adding AI.” They got there because, with the support of Jelou AI, they operate on systems designed around how people actually interact today.

2026 Won’t Be the Year to Experiment, It Will Be the Year to Decide

The debate will no longer be whether system transformation is worth it. It will be whether waiting was a mistake.

Companies that reach that point will still be operating across two different realities: how people already interact today, and how their systems are still trying to support them.

That’s exactly what Andreessen Horowitz is pointing to:

The biggest risk will be continuing to operate on foundations that no longer fit the real world.

At Jelou, closing 2025 with more than 100 million dollars in operations inside the chat wasn’t a goal in itself. It was the natural consequence of operating on systems designed for this new reality, not of patching the old one.

That’s why the real risk is no longer moving forward, but standing still after the ground has already shifted.